Are high interest rates holding you back on buying a home right now?

Are you considering renting vs buying? I would love to help you figure out if buying or renting is a better option for you. Let’s take a look and visualize buying now, then refinancing when the interest rates lower. Buying can seem scary, but let’s look at what is really happening—the big Picture between buying and renting. How much money will you be investing in your home or someone else’s?

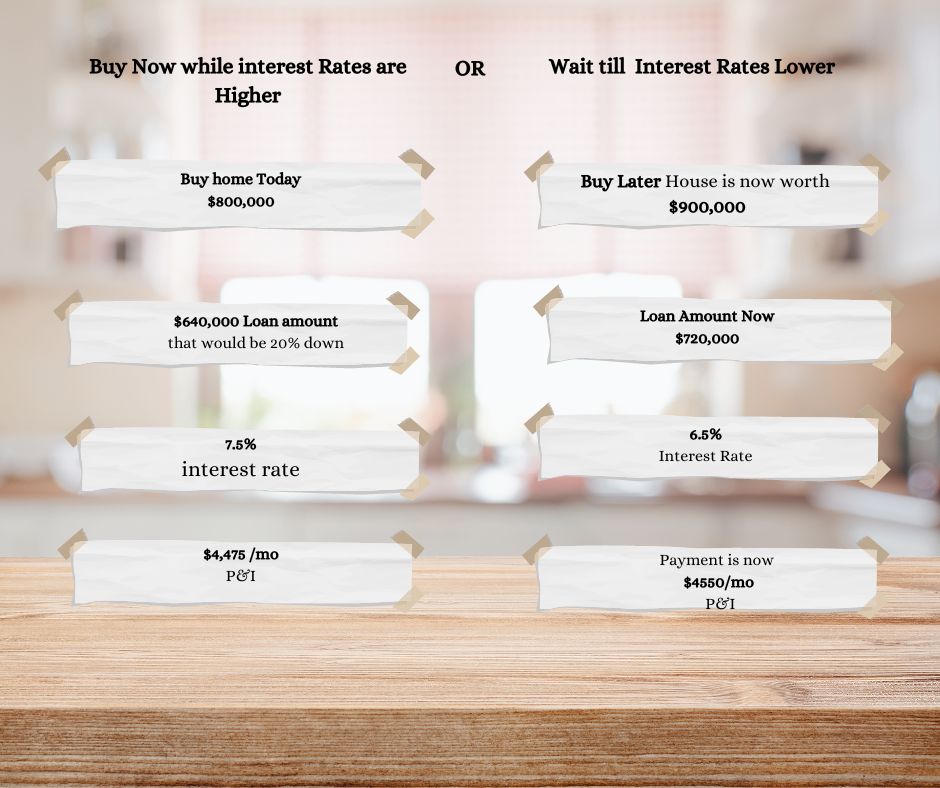

Though interest rates seem high, is it better to buy now and refinance later or wait?

As we do the math for today’s loan, it feels like things are too high and out of reach. Feeling a need to wait until the rates go down. However, will that really save you money?

Will waiting actually save you money?

(1) The $900,000 worth of the house you desired will now rise to $800,000.

(2) The equity the house has gained is likewise not yours by waiting.

(3) Should you want to postpone, the loan amount would rise along with the down payment you would have to make.

You thereby forfeit the $100,000 in equity in addition to having a larger down payment and a larger loan amount.

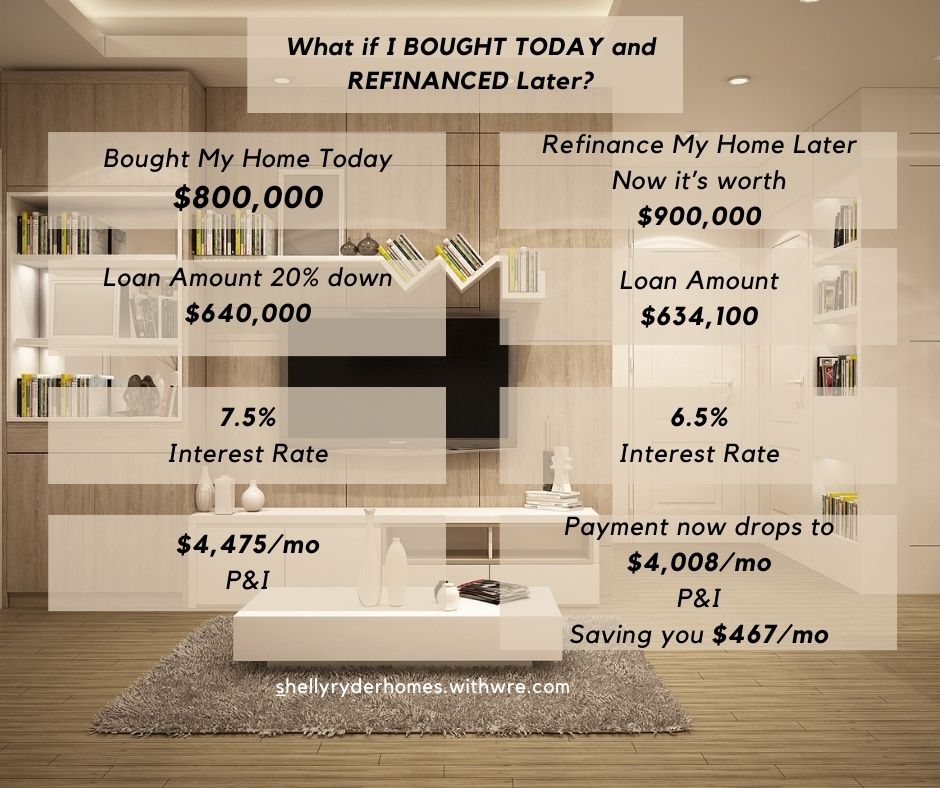

So logically, no! If you decide to buy now even when interest rates are higher, then take advantage of refinancing when rates drop. You will have gained equity in your new home after refinancing your existing loan and dropping your monthly payment. This saves you almost $467 monthly.

All things considered, in the scheme of things, your house’s value grows while you can lower your monthly payment by refinancing.

So think about it. If you have more questions or if I can help you in any way, please reach out to me here. I would love to help you on this journey.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link